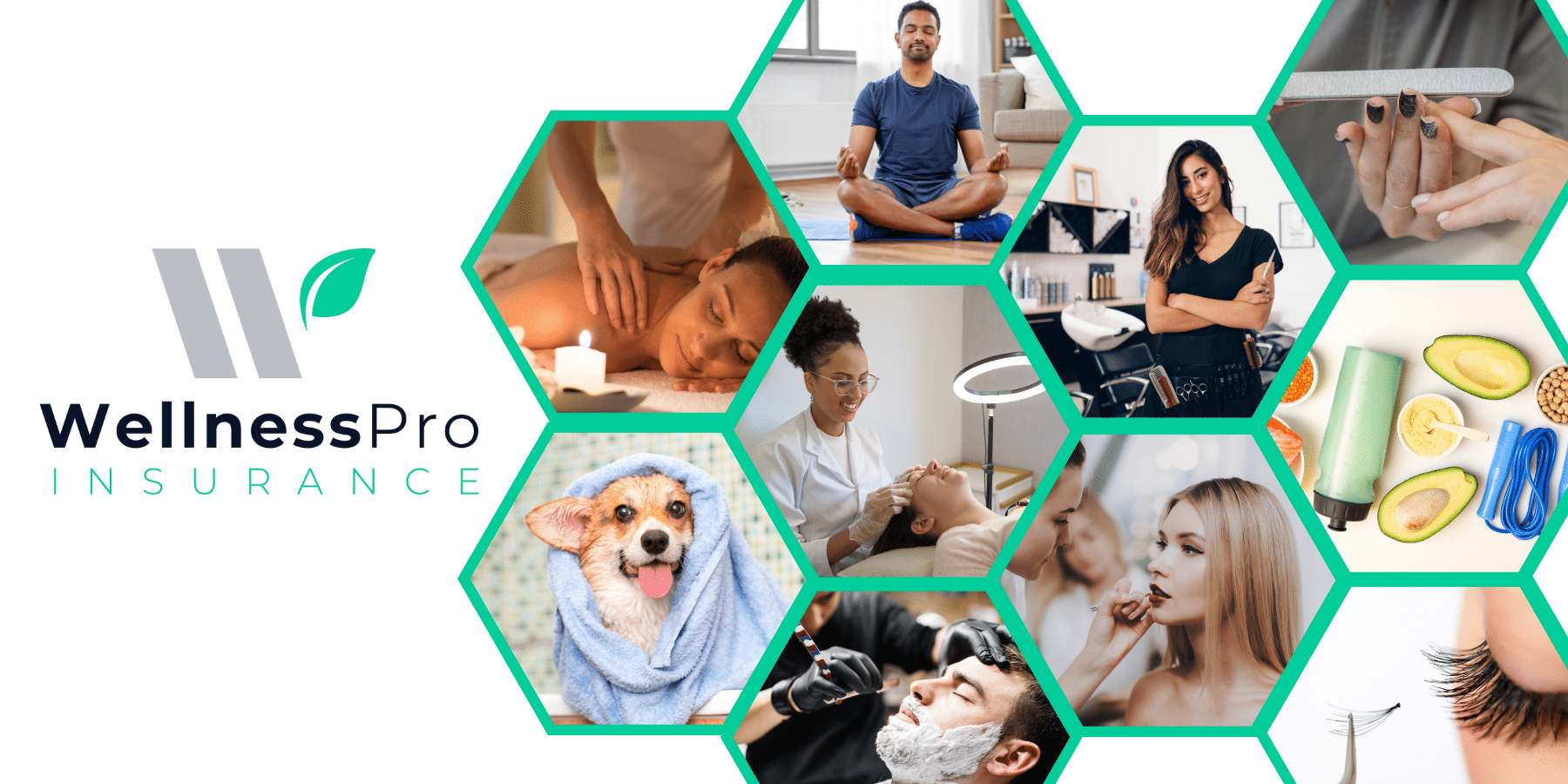

Who We Cover (and Why Insurance Is Important for Businesses in Wellness)

You may wonder why insurance is important for businesses like yours.

In truth, your wellness practice is more than a business; it’s your craft, your inspiration, and your passion. Whether you’ve committed yourself to one service or dabble in several, you go above and beyond to keep your clients looking and feeling their best.

If you do all that for your clients, shouldn’t your insurance do something similar for you?

With WellnessPro, your mission is our mission, too. While you look after your clients’ wellbeing, we look after yours. The wellness pros in our circle love our affordable rates, superior customer service, and tailored insight into the types of claims your industry battles most.

We see lots of questions about why insurance is important for a business in the wellness community. People ask us:

- Why should you have professional liability insurance? Why do I need business insurance?

- How do I know if I need professional indemnity insurance?

- Who gets professional indemnity insurance with WellnessPro?

- How long does it take to get indemnity insurance?

- What is an example of a situation that would likely require professional liability insurance coverage?

- How do I find the right business insurance?

We answer these questions about who we cover and help you determine if our professional insurance coverage is a good fit for you.

Why Insurance Is Important for Businesses in Wellness

Have you wondered why getting business insurance is important? Or why should you have professional liability insurance as a wellness professional?

There are different kinds of insurance, each with its own business insurance benefits for wellness specialists.

Professional liability—also known as professional indemnity or errors and omissions (E&O) insurance—protects you from accusations of mistakes or incomplete services. What is an example of a situation that would likely require professional liability insurance coverage? For starters, a client could accuse you of performing an incomplete service or doing your job incorrectly.

By comparison, if your client has a slip and fall incident or you accidentally damage your client’s property while doing your job, you’ll want general liability insurance.

Insurance can also protect you from claims involving personal and advertising injuries. These include accusations of slander, copyright infringement, written defamation, and more. Our policies cover these, along with product liability (for resale products, not ones you’ve personally manufactured, repackaged, or relabeled) and fire damage to rental properties.

How do I know if I need professional indemnity insurance?

You might ask: How do I know if I need professional indemnity insurance? If you run your own wellness business, then insurance is a must-have. Should someone file a lawsuit against you, insurance protects your hard-earned assets by limiting your defense costs. Otherwise, you could face enough expenses to drive you out of business permanently.

Why insurance is important for businesses ties back to loving what you do and wanting to safeguard yourself against the unexpected. More than just the walls you operate in, it’s also about your livelihood, future, and financial stability.

How long does it take to get indemnity insurance (or the others mentioned)? With WellnessPro, you can get proof of insurance the same day you apply. No quotes, no hassles. Click the button below to learn more about our professional and general liability insurance coverages.

Who gets professional indemnity insurance with WellnessPro?

We’ve shared why insurance is important for businesses and independent service providers. Now, you may be wondering: How do I find the right business insurance?

The qualities of a good insurance company tell you if they specialize in your line of work. Learning how to choose business insurance is like learning how to tell the difference between a top-tier restaurant and a chain.

The average chain restaurant (like some insurance) will offer everything under the sun. Every meal could be good. But they won’t be great, like if you went to a top-tier restaurant that offered just a niche menu of items they specialize in.

Similarly, when it comes to insurance, you’ll want to look for a provider that really understands you. Your discipline will be one of the few they cater to—-not one of a thousand. You want insurance like fine dining, and not a so-so buffet.

At WellnessPro, we cater to the wellness world—fitness, alternative medicine, massages, and beauty—for competitively low, annual rates. It’s like finding the top-tier restaurant and getting buffet pricing.

To ensure you’re a great match for our program, we’re breaking down all the disciplines we cover (and the ones we don’t). Continue reading to see if the WellnessPro community is what you’ve been looking for.

Disciplines We Cover

Hair

- Hairstylists and barbers insurance

- Professional insurance for cosmetologists

- Barbers

- Hair designers

- Hairdressers

Why do salons need insurance? You deserve to tackle locks, curls, bangs, fades, colors, and all things hair without the scare (or hassle) of handling claims on your own.

Click below to learn how WellnessPro helps hair care specialists safeguard their businesses.

Beauty Professionals Insurance

- Beauty advisors

- Beauty consultants

- Fashion consultants

- Beauticians

- Cosmetologists

- Lash stylists

While clients say “yes” to the dress, don’t say “yes” to the stress of paying out expensive claims. It’s the #1 reason why insurance is important for businesses involving beauty advice and makeup.

Makeup

- Makeup artists

- Stylists

- Wedding makeup specialists

- Cosmetologists

What would you do if a client accused you of causing an allergic reaction, canceling unfairly, or failing to provide the agreed upon service?

These lawsuits can (and do) happen. Luckily, we have just the right coverage to prepare you and your business.

Dog and Pet Groomer Insurance

- Dog groomers

- Dog stylists

- Grooming technicians

- Pet bathers

Pets are more than just pets. They’re your clients’ family. When pups leave a grooming salon with alleged injuries or trauma, their owners can get upset enough to file claims against the salon or groomer they hold responsible.

Don’t walk into a claim unguarded (or should we say, “unleashed”?). Get the coverage you need to handle fur babies with confidence.

Tanning

- Airbrush tanning insurance

- Tanning salon owners

- Spray tan technicians

- Tanning consultants

Chemicals and bad spray tans can stir up anxiety for clients. With our insurance, it doesn’t have to be the same for you. Get stress-free claims handling with WellnessPro.

Click below to explore why insurance is important for business owners who offer tanning services.

Insurance for Bodyworkers

- Massage therapists insurance

- Acupuncture professional insurance

- Insurance for cupping therapists

Bodywork is an ancient practice that provides relief for many people. But in some cases, massages, acupuncture, and cupping can also present significant risk.

Click the individual specialties linked above to learn how we protect each one.

Skincare Professions

- Estheticians (esthetics) insurance

- Estheticians and aestheticians

- Cosmologists

- Skincare specialists

- Skincare consultant

- Facialists

Glowing reviews, a wrinkle-free business plan, and tight training credentials—All that’s missing for a gold star skincare career is professional insurance to back you up.

Learn why insurance is important for businesses in skincare. Click the button below.

Nutrition and Fitness Instructor Insurance

- Insurance for yoga teachers and instructors

- Aerial yoga instructor insurance

- Dance instructors insurance

- Personal trainers insurance

- Insurance for pilates teachers

- Pole fitness instructors insurance

- Sports coach and recreational fitness insurance

- Insurance for nutritional therapists and consultants

- Dance instructors insurance

- Aqua aerobics instructor insurance

- Fitness coaches

- Fitness Consultant

Why do personal trainers need insurance?

When you’re dealing with something as nuanced as fitness and weight loss, you’re bound to have a client or two who feels disappointed with their results.

Our coverage allows you to explore a variety of disciplines under one insurance policy. Click the individual specialties linked above to learn how we protect each one.

Alternative Medicine and Wellness

- Aromatherapist insurance

- Ayurvedic practitioner insurance

- Insurance for biofeedback practitioners

- Insurance for ear candling professionals

- EFT experts

- Wellness coaches

- Energy worker insurance

- Insurance for herbalists

- Naturopath insurance

- Health and wellness life coaches insurance

Your clients love more natural options and the feeling of being in control of their options. But alternative medicine does carry some risk. That’s why insurance is important for a business like yours. Don’t let the stress of potential injuries, bad side effects, or clients’ disappointment with results stop you from healing. Click the individual specialties linked above to learn how we protect each one.

Tattoo, Body Piercing, and Permanent Cosmetics Insurance

- Tattoo artists

- Tattooers

- Tattooists

- Body piercers

- Body modification artists

Tattoos and piercings are often tied to self expression, a new chapter in someone’s life story, a cultural tradition, or just a good time with friends. They’re fun—fun to get and fun to provide.

Still, tattoo and piercing artists know the art carries risks, like allergic reactions, infections, scars, and other complications. Perform your craft with confidence and peace of mind by starting every session prepared. Click the bulleted links above to learn how WellnessPro can safeguard you and your modification art business.

Nail Professional Insurance

- Manicurists

- Pedicurists

- Nail technicians

- Nail artists

Your work is art. Don’t leave it out to dry (metaphorically speaking) without specialized insurance coverage.

Services and Techniques NOT Covered

Unfortunately, there are a few higher-risk services our program does not cover. If a conflict turns into a claim, being aware of these exclusions can prevent you from getting caught off guard.

Please take note of the following procedures outside our policy’s coverage:

- Hot stones (unless you have 100 hours of hot stone training)

- Any massage using implements other than the body

- Medical spa treatments such as Botox, laser treatments, lancets, and cosmetic surgeries

- Chemical peels

- Brazilian waxing

- Manipulations or adjustments of the human skeletal structure

- Diagnosis, prescriptions, and service that requires a license to practice chiropractic, osteopathy, physical therapy, podiatry, orthopedics, or any other branch of medicine

- Psychological therapies

- Sexual misconduct, inappropriate touch, and communicable diseases

Have questions? Let’s chat.

Do you have any remaining questions about your profession and if we cover it? Still not sure why insurance is important for businesses in fitness, nutrition, beauty, or bodywork?

Fill out a contact form below to get in touch with a WellnessPro team member.